Supporting Surveyors in the Age of Autonomous Vessels

May 27, 2025

Technology is rapidly transforming the maritime industry, reshaping the role of a marine surveyor through advanced data tools, automation, and remote inspection capabilities. Autonomous vessels are becoming increasingly common in marine surveying, offering faster data collection and improved access to hazardous or remote areas.

This technological shift presents new opportunities for efficiency, safety, and enhanced insurance assessments. At the same time, it introduces emerging risks that insurers and surveyors must be prepared to evaluate and manage.

Benefits of Autonomous Technology for Marine Surveyors

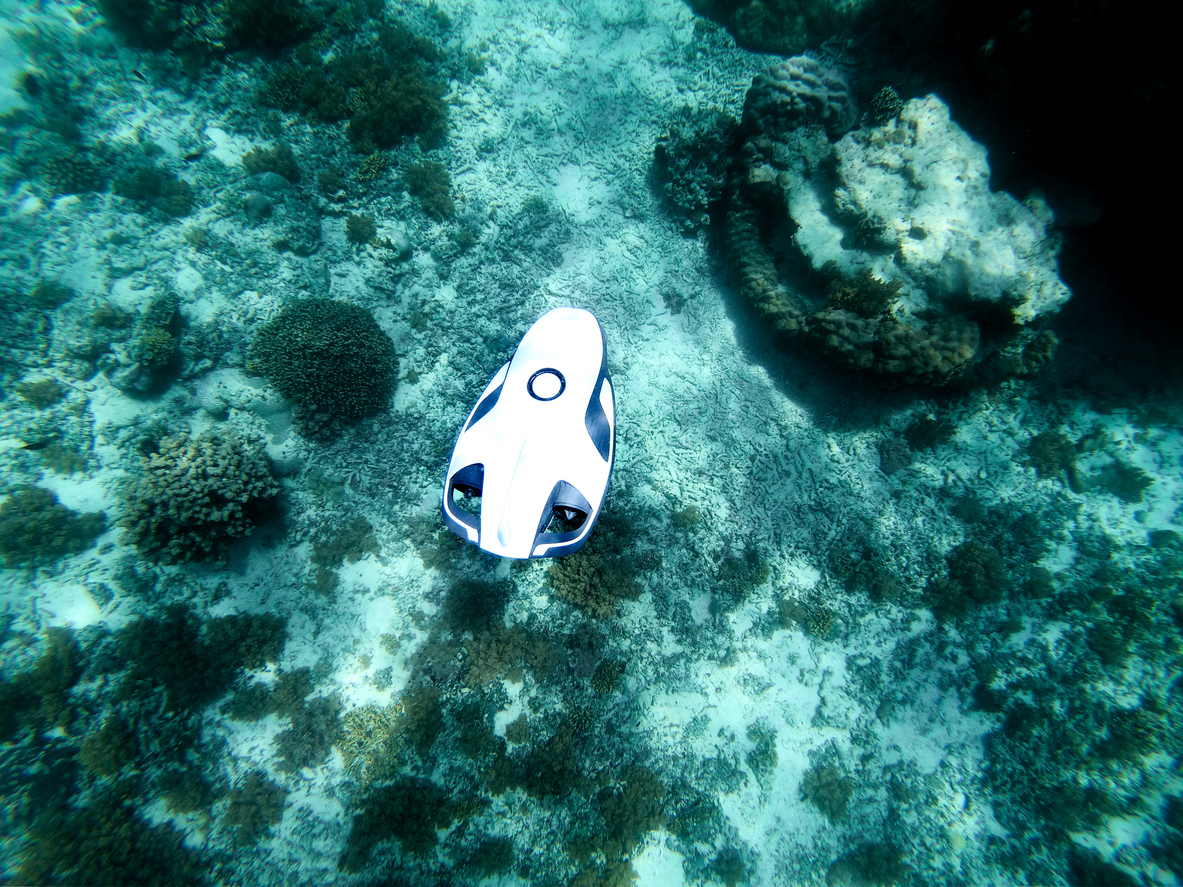

Autonomous vessels are self-guided, unmanned watercraft equipped with advanced sensors, navigation systems, and software that enable operation without direct human control. Surveyors now use these vessels for hydrographic surveys, environmental monitoring, and vessel inspections — particularly in locations that are remote or hazardous for crewed operations.

These vessels deliver key benefits for marine surveyors. Their ability to collect consistent, high-quality data improves survey accuracy and supports better underwriting decisions and claims assessments. By eliminating the need for large crews, autonomous vessels enhance safety, reduce operational risks, and lower staffing demands. The result is a more efficient, cost-effective approach to marine data collection that streamlines traditionally labor-intensive processes.

Emerging Risks and Insurance Implications

While autonomous technology offers clear advantages, it also brings a new set of risks that marine professionals must actively address with proper insurance.

In particular, autonomous systems may be vulnerable to damage during transport or field deployment. Equipment and installation floaters can help cover these exposures. The use of unmanned vessels also raises questions about operational liability; coverage may fall under general liability policies or protection and indemnity.

If a key asset sustains damage, the resulting downtime can disrupt business operations. Business income insurance plays a vital role in maintaining continuity and reducing financial impact during recovery.

Facilities housing these systems are also at risk from events like fire, theft, or severe weather, exposures that fall under a business owner’s policy or commercial property insurance. This coverage is especially important during hurricane season, when wind and water damage become more likely across coastal operations.

Why Merrimac Marine Supports Surveyors Adapting to Tech

Merrimac Marine understands the challenges faced by marine surveyors as technology reshapes risk assessment. The company offers flexible underwriting solutions designed to align with these changing risk profiles. This approach helps surveyors and insurers manage emerging exposures while embracing innovation.

Merrimac Marine works closely with agents to develop proactive coverage that meets the changing needs of the maritime industry. Contact Merrimac Marine Insurance for tailored solutions designed to protect your marine surveyor clients against today’s unique risks.

About Merrimac Marine Insurance

At Merrimac Marine, we are dedicated to providing insurance for the marine industry to protect your clients’ businesses and assets. For more information about our products and programs, contact our specialists today at (800) 681-1998.